Ottawa, Ontario--(Newsfile Corp. - October 30, 2024) - Thermal Energy International Inc. (TSXV: TMG) (OTCQB: TMGEF) ("Thermal Energy" or the "Company"), a provider of innovative energy efficiency and carbon emission reduction solutions to major corporations around the world, today reported its financial results for the first quarter ended August 31, 2024. All figures are in Canadian dollars.

Q1 2025 Highlights:

(Compared to Q1 2024)

- Revenue: $8.5 million (up 63%)

- EBITDAi: $0.6 million (up 33%)

- Net income: $0.3 million (up 91%)

- Cash and Working Capital: $5.0 and $3.8 million respectively

- Order intake: $2.8 million (down 15%)

- Order backlogii was $13.5 million as at August 31, 2024 (up 17% year-over-year) and increased to $18.4 million as at October 28, 2024

Overview

"We had an exceptional first quarter with record revenue and the strongest Turn-key Project revenue we've seen since before the pandemic," said William Crossland, Thermal Energy CEO. "The quarter marked the highest gross profit since our record-setting fourth quarter of fiscal 2023, which benefited from a very favourable product mix. Importantly, EBITDA and net income in the first quarter were also both up significantly from the first quarter of last year and when compared to the last two sequential quarters."

"While this is an exciting time for Thermal Energy, our revenues, especially from Turn-key Projects can be quite lumpy depending on the timing of projects. As such, management and the board tend to focus more on the trailing twelve months and longer-term results. In this regard, our record first quarter revenue propelled our trailing twelve months revenue to a new all-time high of $29.2 million, up 26% year-over-year - a clear indication of the continued momentum in the business and the strong demand for our proven energy efficiency and carbon emissions reduction solutions."

Summary Financial Results

| In thousand except % data | Three months ended Aug. 31, 2024 | Three months ended Aug. 31, 2023 | Trailing twelve months ended Aug. 31, 2024 | Trailing twelve months ended Aug. 31, 2023 |

| Revenue | $8,469 | $5,183 | $29,166 | $23,152 |

| Gross profit | $3,525 | $2,767 | $13,210 | $10,987 |

| Gross margin | 42% | 53% | 45% | 47% |

| Operating expenses | $3,079 | $2,477 | $11,420 | $9,072 |

| Net income | $309 | $162 | $1,130 | $1,391 |

| EBITDAi | $553 | $414 | $2,127 | $2,372 |

| Cash position | $5,048 | $4,138 | ||

| Working capital | $3,799 | $3,063 | ||

| Orders received | $2,801 | $3,304 | $28,957 | $26,903 |

| Order backlogii as of August 31 | $13,549 | $11,600 |

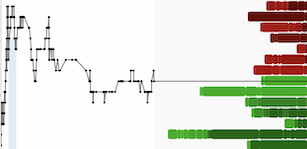

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2616/228305_28b5d745e418a984_001full.jpg

Financial Review for the First Quarter Ended August 31, 2024

First quarter revenue grew 63% year-over-year to a record $8.5 million mainly due to increased sales from turn-key heat recovery projects. Gross profit for the quarter increased by 27% to $3.5 million, mainly due to the higher revenue earned from heat recovery projects.

Operating expenses for the quarter were $603 thousand higher than the same quarter a year earlier. The increase was mainly due to increase in business development costs and salary expense as a result of growth in the Company's sales and engineering personnel and salary raises.

For the quarter, the Company had EBITDA of $553 thousand and net income of $309 thousand, compared to $414 thousand and $162 thousand respectively in the first quarter a year earlier.

At the end of August, cash and working capital balances were approximately $5.0 million and $3.8 million, respectively.

Financial Review for the Trailing Twelve Months ("TTM") Ended August 31, 2024

TTM revenue increased 26% to a record $29.2 million while gross profit increased 20% to a record $13.2 million.

TTM operating expenses increased by $2.3 million to $11.4 million, but $1.6 million of this increase is related to investments made to drive future growth of the business, including:

- $950 thousand for 9 new staff positions including two in sales and marketing, six in engineering and production and one in accounting and administration;

- $320 thousand as part of our "Architecture for Growth" program including our proprietary mobile ap and new global ERP and financial accounting software; and,

- $330 thousand for a new UK-based office and production facility.

Even with the $1.6 million in increased expenses to drive future growth, TTM EBITDA was $2.1 million and net income was $1.1 million, only $300 thousand less than the prior year's twelve-month period.

Business Outlook and Order Summary

Orders received ("Order Intake") during the first quarter totalled $2.8 million. The Company ended the quarter with an order backlog of $13.5 million, up 17% from the $11.6 million at the end of the same quarter in the prior year.

The Company also received $4.9 million in new orders subsequent to quarter end, bringing the current order backlog to $18.4 million as of October 28, 2024. A list and description of recent order highlights is available on page 13 and 14 of the Management's Discussion and Analysis filed today.

Full financial results including Management's Discussion and Analysis and accompanying notes to the financial results are available on www.sedarplus.ca and investors-thermalenergy.com/en/financial-overview.

Notice of Earnings Call and Webcast

Management of Thermal Energy will host an earnings call and webcast today, October 30, 2024, at 8:30 am ET. A question-and-answer session will follow management's prepared remarks, at which time qualified equity analysts will be able to submit questions via the webcast.

The live webcast will be available at https://bit.ly/TMG2025Q1. You may join the webcast via MS Teams on your computer, mobile app or room device. Please join the webcast approximately 15 minutes prior to the earnings call to ensure adequate time for registration and admittance to the webcast.

For more information, including dial-in information (audio only), refer to the Company's press release from October 18, 2024.

Readers are encouraged to subscribe to TEI News to receive strategic news and updates directly to their inbox.

ENDS

For media enquiries contact:

Thermal Energy International Inc.

Canada: 613-723-6776

UK: +44 (0)117 917 2179

Marketing@thermalenergy.com

For investor enquiries:

William Crossland

President and CEO

Thermal Energy International Inc.

613-723-6776

Investors@thermalenergy.com

Notes to editors

About Thermal Energy International Inc.

Thermal Energy International Inc. provides energy efficiency and emissions reduction solutions to Fortune 500 and other large multinational companies. We save our customers money by reducing their fuel use and cutting their carbon emissions. Thermal Energy's proprietary and proven solutions can recover up to 80% of energy lost in typical boiler plant and steam system operations while delivering a high return on investment with a short, compelling payback.

Thermal Energy is a fully accredited professional engineering firm with engineering offices in Ottawa, Canada, Pittsburgh, USA, as well as Bristol, UK, with sales offices in Canada, UK, USA, Germany, Poland, and Italy. By providing a unique mix of proprietary products together with process, energy, and environmental engineering expertise, Thermal Energy can deliver unique, site-specific turnkey and custom engineered solutions with significant financial and environmental benefits for our customers.

Thermal Energy's common shares are traded on the TSX Venture Exchange (TSX-V) under the symbol TMG and on the OTCQB under the symbol TMGEF. For more information, visit our investor website at https://investors-thermalenergy.com or company website at www.thermalenergy.com and follow us on Twitter at https://twitter.com/GoThermalEnergy.

Forward-Looking Statements

This press release contains forward-looking statements relating to, and amongst other things, based on management's expectations, estimates and projections, the anticipated effectiveness of the Company's products and services, the timing of revenues to be received by the Company, the expectation that orders in backlog will become revenue, the anticipated benefits of the Company's current efforts at training and business improvement efforts, opportunities for growth, the Company's belief that it can capitalize on opportunities, the size of markets and opportunities open to the Company and expectations that order intake will bounce back.. Information as to the amount of heat recovered, energy savings and payback period associated with Thermal Energy International's products are based on the Company's own testing and average customer results to date. Statements relating to the expected installation and revenue recognition for projects, statements about the anticipated effectiveness and lifespan of the Company's products, statements about the expected environmental effects and cost savings associated with the Company's products and statements about the Company's ability to cross-sell its products and sell to more sites are forward-looking statements. These statements are not guarantees of future performance and involve a number of risks, uncertainties and assumptions. Many factors, some of which are outside of the Company's control, could cause events and results to differ materially from those stated. Fulfilment of orders, installation of product and activation of product could all be delayed for a number of reasons, some of which are outside of the Company's control, which would result in anticipated revenues from such projects being delayed or in the most serious cases eliminated. Actions taken by the Company's customers and factors inherent in the customer's facilities but not anticipated by the Company can have a negative impact on the expected effectiveness and lifespan of the Company's products and on the expected environmental effects and cost savings expected from the Company's products. Any customer's willingness to purchase additional products from the Company and whether orders in the Company's backlog as described above will turn into revenue is dependent on many factors, some of which are outside of the Company's control, including but not limited to the customer's perceived needs and the continuing financial viability of the customer. The Company disclaims any obligation to publicly update or revise any such statements except as required by law. Readers are referred to the risk factors associated with the Company's business as described in the Company's most recent Management's Discussion and Analysis available at www.sedarplus.ca.

Non-IFRS Financial Measures

The Company believes the following non-IFRS financial measures provide useful information to both management and investors to better understand the financial performance and financial position of the Company.

EBITDA

Management believes that EBITDA (earnings before interest, taxation, depreciation, amortization, impairment of intangible assets, and share-based compensation expense) is a useful performance measure as it approximates cash generated from operations, before tax, capital expenditures and changes in working capital, and excludes impairment of intangible assets. EBITDA also assists comparison among companies as it eliminates the differences in earnings due to how a company is financed. EBITDA does not have a standardized meaning prescribed by International Financial Reporting Standards ("IFRS") and therefore may not be comparable to similar measures presented by other companies. There is no direct comparable IFRS measure for EBITDA.

A reconciliation of net income to EBITDA is shown below.

| Three months ended | ||||||

| August 31, 2024 $ | August 31, 2023 $ | |||||

| Total net income attributable to owners of the parent | 278,290 | 159,243 | ||||

| Total net income attributable to non-controlling interest | 31,182 | 2,587 | ||||

| Interest charge | 87,295 | 113,264 | ||||

| Interest revenue | (31,199 | ) | - | |||

| Income tax expense | 18,342 | 1,783 | ||||

| Depreciation and amortization | 103,425 | 84,133 | ||||

| Share based compensation | 65,306 | 53,319 | ||||

| EBITDA | 552,641 | 414,329 | ||||

Order Backlog

Order backlog is a useful performance measure that Management uses as an indicator of the short-term future revenue of our Company resulting from already recognized orders. The Company includes in "order backlog" any purchase orders that have been received by the Company but have not yet been reflected as revenue in the Company's published financial statements. It is important to note that once an order or partial order is recorded as revenue, the order backlog is reduced by the amount of the newly reported revenue. Order backlog does not have a standardized meaning prescribed by International Financial Reporting Standards and therefore may not be comparable to similar measures presented by other companies.

For additional details on non-IFRS financial measures, please refer to the Company's most recent Management's Discussion and Analysis available at www.sedarplus.ca for more details about these non-IFRS financial measures.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

i EBITDA represents earnings before interest, taxation, depreciation, amortization, impairment of intangible assets, and share-based compensation expense. See note below about non-IFRS measures.

ii Order backlog represents any purchase orders that have been received by the Company but have not yet been reflected as revenue in the Company's published financial statements. See note below about non-IFRS measures.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/228305